Even though consumers tighten their budgets in certain discretionary spending like dining out and luxury goods, interest in travel remains strong. This has translated into a surprisingly steady expenditure on vacations and trips and a subsequent unexpected stability in travel stocks. Ample opportunity beckons investors to take advantage of growing their wealth through this sector if they are looking for travel stocks to buy now.

Ninety-three percent of travelers reported having travel plans within the next six months. Also, the total number of combined trips from both domestic and international travelers in the U.S. is expected to reach pre-pandemic levels again by late 2024. It’s expected that spending on travel will increase yearly and could reach $1.22 trillion by 2027. As interest in travel remains strong, these three travel stocks look promising. They are using technology to reduce their overhead and creating additional avenues to generate revenue.

Viking Holdings (VIK)

Viking Holdings (NYSE:VIK), parent company of the Viking River Cruises brand, just had its initial public offering (IPO) last month. Since then, the company’s stock is already up 8%. But it’s been in business since 1997, growing in popularity and brand recognition year after year.

River cruises, once considered an activity primarily for older travelers, are having a renaissance. Young social media influencers are touting the benefits of traveling across places like Europe via its rivers. It’s convenient and cost-effective. Plus, it allows passengers to see a diverse range of cities across the region while only unpacking once.

Truly, Viking Holdings is a prominent name in the river cruising industry and one of the few publicly traded river cruise companies. And it’s well positioned to benefit from this surge in popularity and continued spending on travel. VIK plans for 10 new vessels to be completed between now and 2026, plus an expansion into land tours and even safaris. Opportunity is knocking for Viking Holdings to capitalize on the luxury vacation market.

The company’s next earnings report won’t be out until July 24. So VIK is a great option for travel stocks to buy now since you can invest before the quarterly update is inked.

Booking Holdings (BKNG)

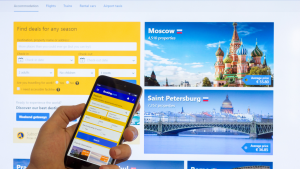

Booking Holdings (NASDAQ:BKNG) has a vast network of subsidiary brands including Priceline, Booking.com, Agoda, KAYAK and OpenTable. It operates in over 220 countries and territories as the world’s largest do-it-yourself travel agency. Through its websites, travelers can book flights, hotels and car rentals as well as restaurant reservations and experiences.

First quarter 2024 results were promising for Booking Holdings. Travelers booked over 300 million room nights in the first quarter, marking a 9% year-over-year (YOY) growth that surpassed management’s expectations. Revenue reached $4.4 billion, a 17% increase YOY and adjusted EBITDA increased 53% to $900 million. Earnings per share (EPS) grew 76% YOY as well. The company’s chief financial officer (CFO) Ewout Steenbergen warned of a potential reduction in room night growth in Q2. However, the Q1 results highlight Booking Holdings’ ability to continue rapidly growing even at a time when the rest of the economy is stagnating.

Also, the company works on leveraging artificial intelligence (AI) software to improve its consumer-facing tools with aims to reduce live agent contact rates and increase bookings. By lowering the customer service cost per transaction and generating more revenue with additional reservations, Booking Holdings has a solid game plan for the future.

US Global Jets ETF (JETS)

The US Global Jets ETF (NYSEARCA:JETS) is an exchange-traded fund (ETF) composed of companies that represent U.S. and international passenger airlines, aircraft manufacturers, airports, terminal services companies and airline-related internet media and services companies. Top holdings include Delta Air Lines (NYSE:DAL), United Airlines (NASDAQ:UAL) and American Airlines (NASDAQ:AAL). Each makes up roughly 11% of the fund. Three quarters of the portfolio is made up of U.S.-based companies. And the other 25% comes from companies in countries like Canada, Japan, Mexico, Brazil and the U.K.

Since the pandemic, the airline industry has been struggling to bring back customers and retain profits. Increased fuel costs, labor shortages, contract disputes and recent negative press surround the quality of Boeing’s (NYSE:BA) aircraft have all contributed to a downward trend in airline stocks. But, for investors looking at travel stocks to buy now, JETS offers a perfect opportunity to buy the dip.

While JETS is a long way from its pre-pandemic high of $32, analysts expect a 23% upside with an average price target of $24.28. Year-to-date (YTD), it’s up 5%. While it may be a long term play, investing in JETS now while the sector is still experiencing troubles could lead to big gains when the airline industry rebounds, which it is sure to do.

On the date of publication, Philippa Main held a LONG position in VIK stock. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.