After years of hiking and maintaining high interest rates, the Federal Reserve is likely to enact its first rate cut of this cycle tomorrow. And our work suggests that could mean the start of a major stock market rally that lasts into 2025.

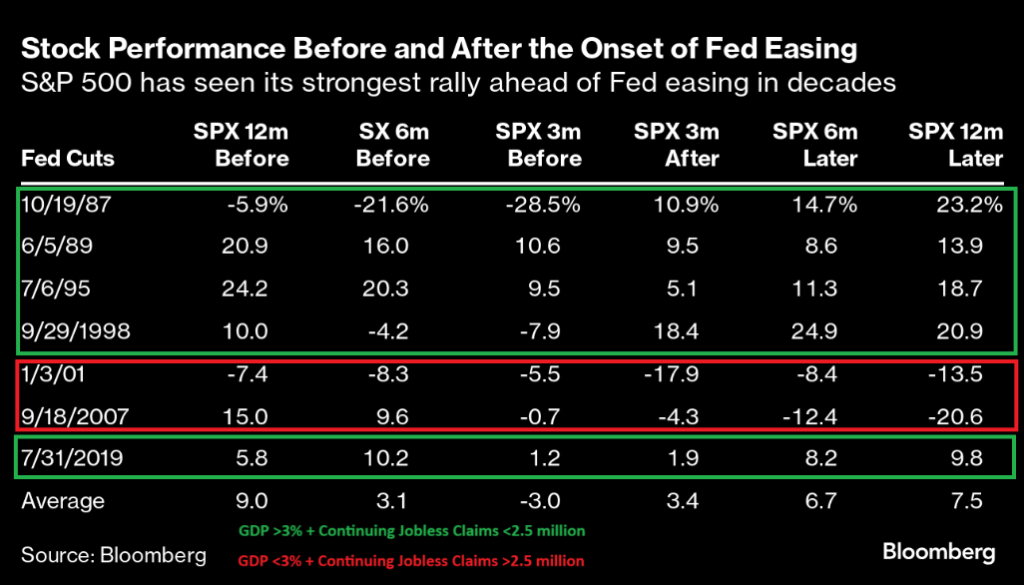

Now, it’s important to understand that stocks do tend to rally after the Fed cuts rates. Since 1987, the central bank has embarked on seven different rate-cutting cycles, according to Bloomberg. In five of those instances, the S&P 500 rallied three, six, and 12 months after the first rate cut, with nearly 8% average returns the following year.

Empirically speaking, rate cuts do tend to spark stock market rallies.

But ‘good’ rate cuts usually spark massive stock market rallies. And that’s exactly what we’re approaching right now.

You see; as we’ve mentioned in previous issues, rate cuts can be ‘good’ – or ‘bad.’

When the Fed is proactively cutting interest rates while the economy is still healthy (positive GDP, low joblessness, etc), rate cuts are ‘good.’ Those cuts breathe life back into a sluggish economy and tend to rejuvenate economic activity over the next several months. Stocks usually soar when we get good rate cuts.

Bad rate cuts, on the other hand, happen when the Fed is reactively cutting interest rates in response to an already-troubled economy (weak GDP, high joblessness, etc). Those cuts fail to resuscitate a dying economy, which continues to weaken instead. And stocks suffer as a result.

With that in mind, let’s consider the seven rate-cut cycles we’ve seen since 1987 – and why they indicate hefty stock gains ahead.

Repeating Rate Cut History

Five of those previous seven rate-cut cycles – in 1987, 1989, 1995, 1998 and 2019 – were ‘good.’ At their onset, GDP was typically running above 3%, while continuing jobless claims were often running below 2.5 million claims. Economic strength was good. Joblessness was low. And in each of those “good” rate-cutting cycles, the S&P 500 rallied in the 3 months after, 6 months after, and 12 months after the first cut, with average 12-month returns of nearly 20%.

Two, though, were ‘bad’ – 2001 and 2007. At the onset of those rate-cut cycles, GDP was typically running at 2% or lower, while continuing jobless claims were above 2.5 million claims (and climbing). In other words, the U.S. economy was feeble, and joblessness was high. And in those two ‘bad’ rate-cutting cycles, the S&P 500 dropped in the three, six, and 12 months after the first cut, with average 12-month drops of nearly 20%.

Right now, the economy is currently growing at a 3% clip. Continuing jobless claims are running below 2 million. This current economic setup suggests we are going into a ‘good’ rate-cutting cycle.

And in recent ‘good’ cycles, stocks soared in the 12 months after the first cut.

That’s why we think tomorrow’s cut could kickstart a huge enduring rally in stocks.

The Final Word

We think this rally could be particularly powerful.

That’s because the rate-cutting cycle we are entering right now draws strong parallels to that of 1998/99, wherein tech stocks absolutely surged higher.

In the late 1990s, stocks were benefitting from the emergence of new internet technologies. Companies were investing copious amounts of cash to build new internet infrastructure and create next-gen products and services. That led internet stocks to soar on Wall Street.

Then, in the summer of 1998 the economy slowed – not by much, but enough to worry investors, cause some stock market volatility, and compel the Fed to cut interest rates. Those rate cuts re-stabilized the economy. And that only added fuel to the internet boom’s fire, causing those stocks to explode higher in 1999 and 2000. Indeed, from late 1998 to early 2000, the Nasdaq 100 rose more than 300%!

We see strong parallels to today – just with an ‘AI boom’ instead of an ‘internet’ one.

Indeed, over the past two years, stocks have been benefitting from the emergence of new AI technologies. Companies have been investing hand-over-fist to build new AI infrastructure and create next-gen products and services. AI stocks have soared on Wall Street.

Now the economy is slowing – not by much, but enough to worry investors, cause some stock market volatility, and compel the Fed to cut interest rates. Those rate cuts should re-stabilize the economy. And that should add fuel to the AI boom’s fire, causing AI stocks to explode higher into 2025 and 2026.

That’s why we are particularly excited about these upcoming rate cuts.

This cycle may be more than just ‘good.’ It could be ‘great.’

Find out how we’re preparing for this potentially ‘great’ rate-cutting cycle that’s just hours away.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.