Looking to sell some materials stocks? The materials sector has always been the bedrock of the global economy, providing essential components for the functioning of various industries. However, in the last few years, the sector has faced slow growth, high interest rates and high inflation. Not only that, but this slowed demand is trickling down to various industries.

While we are now seeing some recovery in materials, the threat of a hard landing and potential recession still puts investors on high alert. Knowing which stocks can put your portfolio at an increased risk is important — and these material stocks are right at the top of our to-sell list.

Ardagh Metal Packaging S.A. (AMBP)

Ardagh Metal Packaging S.A. (NYSE:AMBP) is a metal beverage can supplier in Luxembourg that provides beverage cans to various brand owners. This includes beer, soft drinks, pre-mix cocktails, teas, sparkling waters and wine cans. Ardagh Metal Packaging can package solutions for national, regional and multi-national clients in its 23 European and American facilities.

AMBP recently reported a 10% increase in revenue and a 22% rise in adjusted EBITDA. However, a closer look at its financials shows a 75% decline in net profit — a definite red flag. This might suggest an issue with cost or operational management.

In addition, the softening demand conditions in Europe have resulted in a lower-than-expected performance and raises concerns about the company’s position as a market player. Further, the potential closure of its Ohio production facility adds to the likely challenges ahead. While its management may be confident with earnings improvement in the future, it still has difficulty overshadowing the glaring issues with demand and cost of operations. If you need to calibrate your portfolio, consider AMBP as one of the materials stocks to sell.

Mercer International Inc. (MERC)

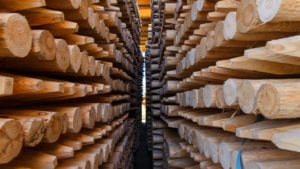

Mercer International Inc. (NASDAQ:MERC) is one of the world’s largest market pulp and timber producers for wood products. Its operations focus on two main segments: pulp for its pulp mills operations in its four pulp mills and Cariboo pulp mill, and its wood segment for its sawmills in Mercer mass timber facility and Friesau sawmill.

The company also offers products like bio extractives and biomaterials, biofuels, green energy, transport services, and logistic services.

MERC’s latest financials reveal nothing short of an abysmal quarter. Their net loss ended at $26 million, a staggering drop from $66.7 million in profit in the year ago quarter. Operating EBITDA also fell by -73.39% YoY. Even with the expansion of its German credit facility and senior note issuance, its financials are still being hit by the decreased revenues, mainly from the pulp and lumber market. Revenue weakness strains the company’s future growth and makes a compelling reason to sell MERC and buy other materials stocks.

Huntsman Corporation (HUN)

Huntsman Corporation (NYSE:HUN) is a chemical and materials company that operates in three main segments: polyurethanes , methylene diphenyl diisocyanate and polyurethane-related products; performance products for its ethylene amines, specialty amines, and tech licenses; and advanced materials for its phenoxy, acrylic, epoxy, acrylonitrile-butadiene-based polymer formulations. The company operates in 30 countries with over sixty manufacturing and R&D facilities.

HUN’s latest financials reported a significant decline on a YoY basis. Net attributable income went to $0, while adjusted net income decreased by 80.85%. Polyurethanes, performance products and advanced materials segments of the business experienced lower sales volumes, unfavorable sales mix and reduced selling prices.

While the company is focused on cost controls and has implemented a savings program, its CEO has highlighted that they anticipate the coming fourth quarter to be its most challenging in recent memory. With the decline in key financial metrics and anticipated difficult market conditions, it’s prudent to sell HUN and look for other materials stocks.

On the date of publication, Rick Orford did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.