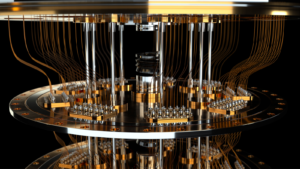

Quantum computing emerges as a pivotal frontier as the tech landscape continually evolves. This article focuses on three undervalued quantum computing stocks, each with growth potential. Despite their undervaluation, these trailblazers are making significant strides in quantum technology, setting the stage for a potential surge in stock prices.

Moving forward, we’ll delve deeper into these undervalued quantum computing stocks. Each company boasts a unique narrative within the quantum computing sector, armed with distinct strategies and offerings. We aim to provide a brief investment thesis for each, equipping you with the insights needed for informed decision-making. So, stay with us as we unravel the promising potential of these stocks in the thrilling world of quantum computing.

IonQ (IONQ)

IonQ’s (NYSE:IONQ) strong growth and partnerships with major tech companies like Amazon (NASDAQ:AMZN) make it an attractive investment. Despite recent volatility, the company’s positive outlook and increasing bookings suggest a promising future.

The company announced the availability of its quantum computer, IonQ Aria, on Amazon Web Services (AWS) in May this year. This addition to AWS’s quantum computing service, Amazon Braket, expands IonQ’s existing presence on the platform following the debut of IonQ’s Harmony system in 2020. IonQ Aria, with its 25 algorithmic qubits, allows users to run more complex quantum algorithms to tackle challenging problems.

The expansion of IonQ’s ecosystem with its partnership makes it an undervalued quantum computing stock to consider. IONQ stock’s performance also makes it a momentum play. It’s up over 330% year-to-date, and its sales grew 115% quarter-over-quarter.

Microsoft (MSFT)

Microsoft (NASDAQ:MSFT) has been doing well, but I would still rank it as one of the undervalued quantum computing stocks. This is primarily due to its competitive positioning and how it harnesses quantum technology. Simply put, its application of topological qubits is seen as a high-risk, high-reward venture. At the same time, other companies like IonQ build less experimental but perhaps less effective quantum systems.

It’s theorized by some that Microsoft’s quantum approach will lead to lower fault tolerance and, ultimately, a faster time to market for a commercial quantum computer. It should be noted this is firmly in the realm of speculation, as MSFT’s approach is yet to be proven definitively. But it has made significant headway in its R&D efforts, which suggests it’s firmly on the right track.

MSFT is also benefiting from the rise of generative AI with its subscription service for its Office suite of products. This led to the company reaching a new all-time high in July.

Quantum Computing Inc (QUBT)

Quantum Computing Inc (NASDAQ:QUBT) offers a unique opportunity to invest in a smaller, niche player in the quantum computing field. The company’s focus on hardware and software development could position it well for future growth in the quantum computing market.

QUBT is a penny stock with a market cap of $90 million. Still, it has big plans for the future. Its flagship product is the Reservoir Computer, a compact hardware device designed to make neuromorphic hardware accessible and affordable. Neuromorphic computing differs from quantum as it attempts to mirror how neurons and synapses work in a human brain. The advantage is that it lets AI models learn in parallel, as opposed to sequentially in traditional computing, thus allowing them to perform better at tasks such as pattern recognition.

We may see an arms race between neuromorphic computing and quantum as the de facto standard. In a small way, this could be compared to the race between HD DVDs and Blu-ray discs. Both situations involve competing technologies vying to become the dominant standard in their respective fields. Although quantum and neuromorphic hardware technologies are not direct competitors, from an investor’s point of view, it may be worth diversifying into both forms of tech as we don’t know which will come out on top until later.

On the date of publication, Matthew Farley did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.